2024 Irs Schedule B – New technology systems and the addition of cryptocurrency on tax forms are just some of the IRS developments to watch in 2024. . and then calculate your capital gain or loss, reported on Schedule D. If you only purchased crypto last year, you can check “no.” And, of course, you need to report any crypto income if you received .

2024 Irs Schedule B

Source : form-941-schedule-b.pdffiller.comIRS Refund Schedule 2024 Date to recieve tax year 2023 return!

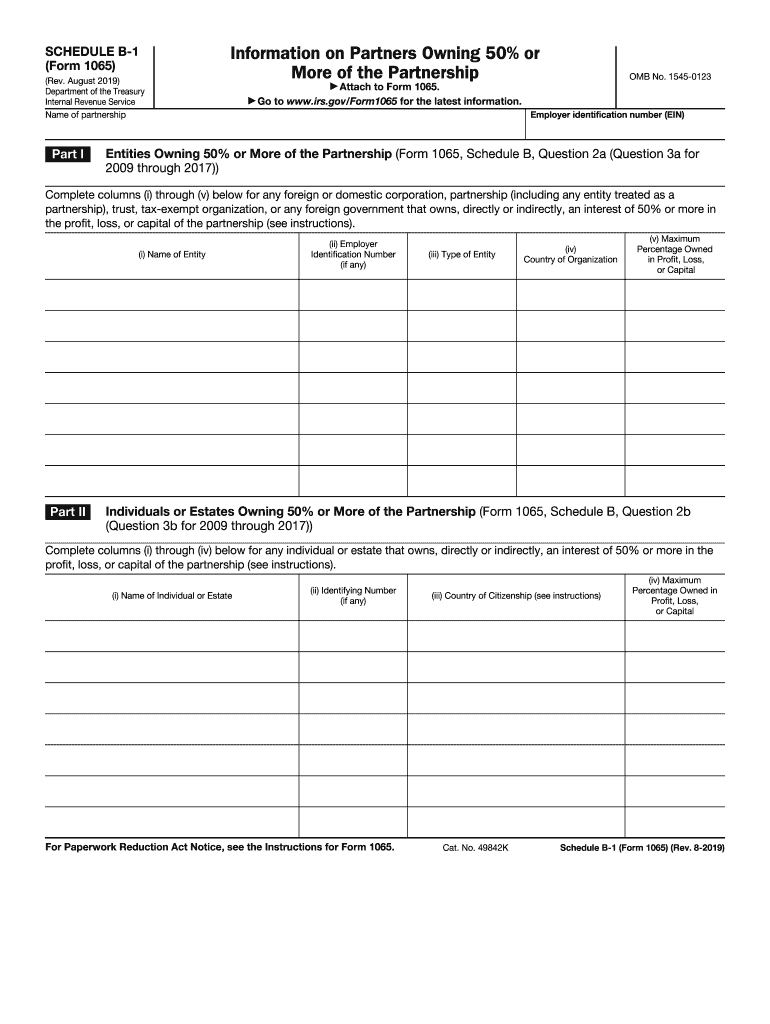

Source : www.bscnursing2022.com2019 2024 Form IRS 1065 Schedule B 1 Fill Online, Printable

Source : form-1065-schedule-b-1.pdffiller.comIrs Schedule B for 2018 2024 Form Fill Out and Sign Printable

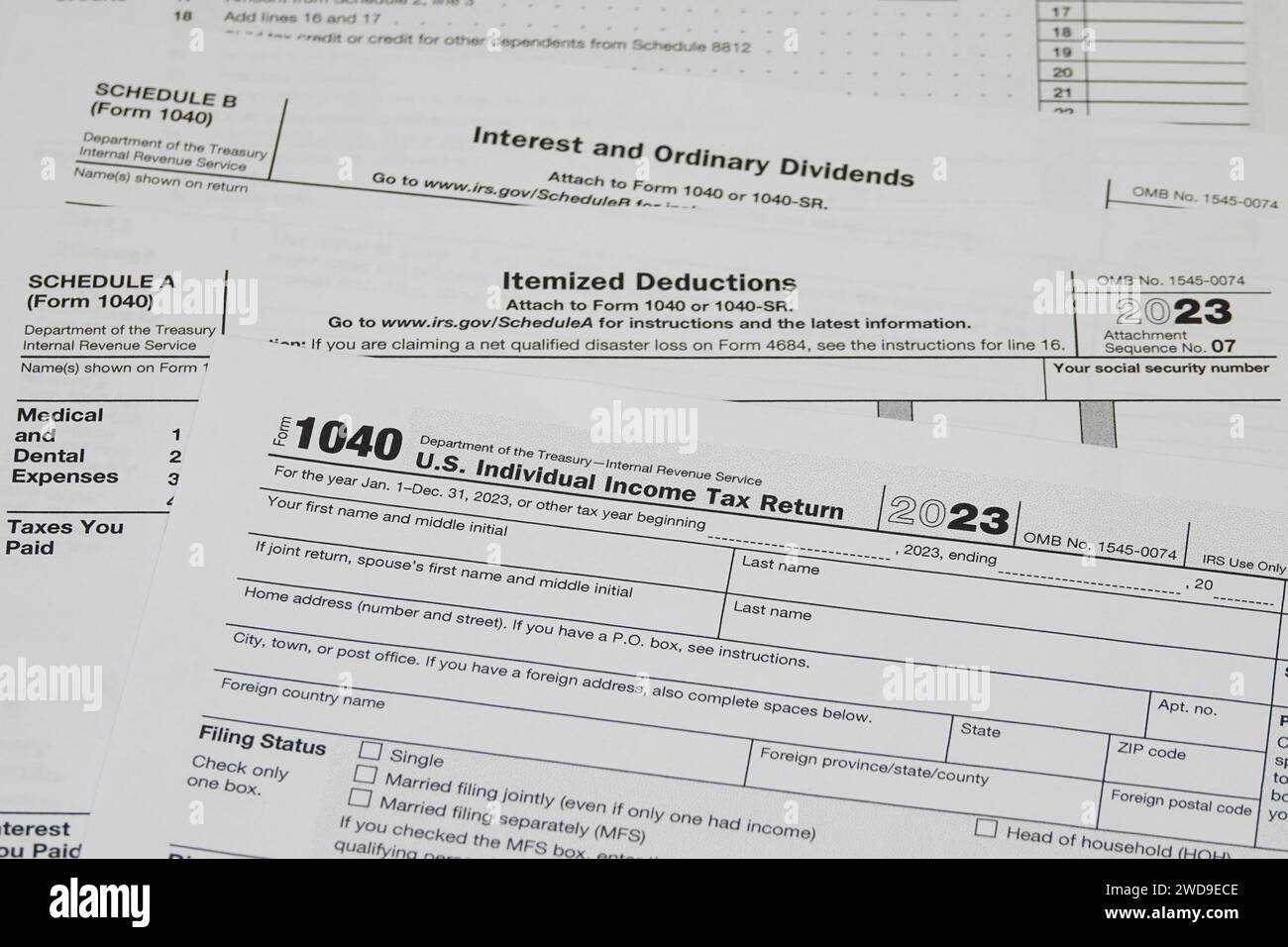

Source : www.signnow.comItemized deductions hi res stock photography and images Alamy

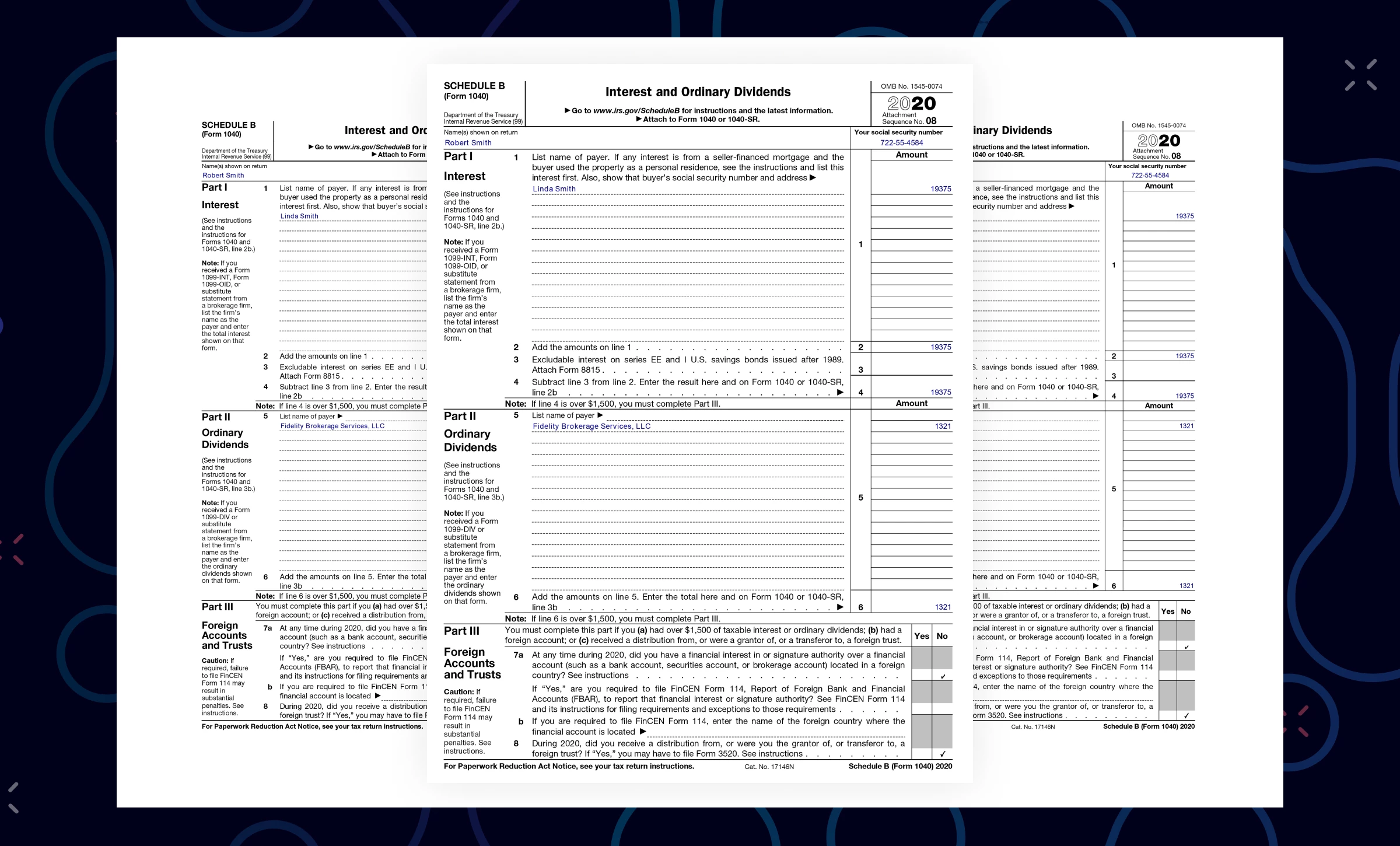

Source : www.alamy.comIRS Form 1040 Schedule B 2020 Document Processing

Source : www.ocrolus.comIRS Schedule B (1040 form) | pdfFiller

Source : www.pdffiller.comForm 1040 For IRS 2024 | How To Fill Out Schedule A B C D

Source : nsfaslogin.co.zaIRS Refund Schedule 2024 Date to recieve tax year 2023 return!

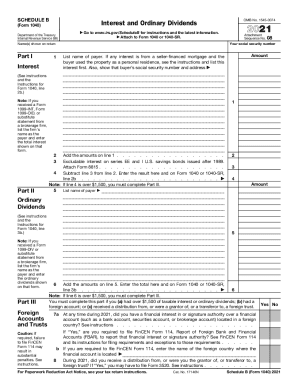

Source : www.bscnursing2022.comNew IRS Schedule B Tax Form Instructions and Printable Forms for

Source : www.wivb.com2024 Irs Schedule B 2017 2024 Form IRS 941 Schedule B Fill Online, Printable : Made money from theft, bribery, or illegally selling drugs last year? You should report it on your taxes, the IRS says. . Because personal loan funds must be repaid, the IRS does not categorize personal loans as taxable income. That means you won’t need to pay taxes on the money you receive. However, if the lender agrees .

]]>